Share

0

/5

(

0

)

In 2009, blockchain was introduced as a novel concept that aimed to transform numerous aspects of established digital practices. Blockchain technology laid the foundation for several breakthroughs in the online landscape, with the financial sector being one of the biggest benefactors.

The conception of decentralised finance (DeFi) was a watershed moment for financial markets, challenging the conventional ways of centralised financial institutions. With DeFi ecosystems, financial institutions, businesses, and individuals have discovered a new way to conduct transactions, obtain financing and trade with digital assets.

This article discusses the nature of DeFi ecosystems and their essential role in the future of financial operations.

Key Takeaways

DeFi is a blockchain-based financial methodology that aims to eradicate the limitations of centralised finance.

DeFi was conceived to eliminate issues with transparency, anonymity, speed, and cost of financial transactions.

While DeFi offers several core improvements over centralised finance, it has notable shortcomings related to volatility, security, and accessibility.

DeFi Explained

Decentralised finance is a novel methodology to conduct financial transactions without third-party intervention, excessive fees, needless bureaucracy and unreasonable delays. To bring this concept to reality, DeFi utilises blockchain's distributed ledger technology. Powered by blockchain methodology, the DeFi model is entirely decentralised, free of accumulated transaction costs and corresponding processing delays.

Thus, DeFi technology relies on blockchain networks, specifically smart contracts (SCs), as they are the base framework for building DeFi solutions. Smart contracts are blockchain-native programs that enable creators to write various decentralised applications. While SCs are great for creating all types of programs, DeFi applications like decentralised exchanges are easily the most demanded. The Ethereum network is the most popular benchmark for DeFi-related SCs, as it offers robust core features and seamless scalability options.

With smart contract capabilities, DeFi developers can quickly build financial applications that resemble the traditional financial market. From simple payment and trading platforms to complex trading mechanisms and borrowing funds, DeFi has become a fully-fledged alternative to conventional finance.

However, the critical distinction is that DeFi is fully decentralised, letting users execute financial operations without any third-party intervention. In practice, this means that DeFi transactions are not monitored, controlled or examined by any parties aside from those involved.

[aa quote-global]

Fast Fact

DeFi methodology is based on smart contracts, which enable various decentralised applications to run without central authority.

[/aa]

How Does DeFi Work?

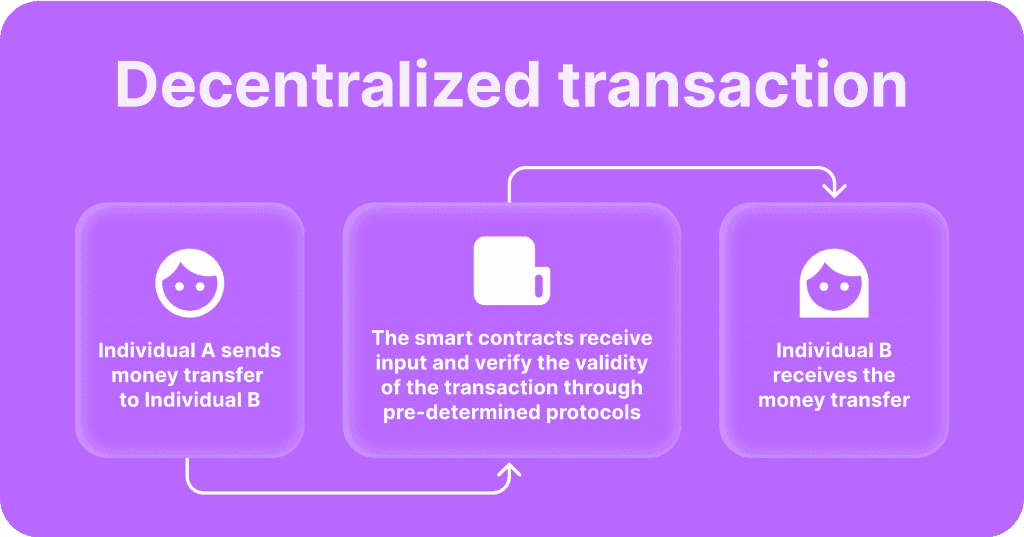

As mentioned above, DeFi technology works based on the smart contract capabilities of blockchain networks. With SCs, creators can effectively program applications' terms, conditions and outcomes, creating various financial solutions. Another great feature of smart contracts is that they can be almost entirely automated. With expertly detailed pre-conditions and appropriate triggers, smart contracts require minimal human intervention to execute financial transactions.

In practice, SCs work as conditional statements, executing contract outcomes automatically if required conditions are satisfied. To further visualise this concept, let's imagine a simple SC with a command to distribute Bitcoin currency to the second party if the first party received the corresponding Ethereum currency. While this is a simple currency exchange, it would take several checks and confirmations in the case of fiat currency in the traditional financial system.

However, with SCs involved, the currency exchange process becomes as simple and seamless as it is in concept. Two parties exchange currencies without excessive checks and commission fees since SCs automatically monitor the transactions and ensure they receive their respective funds. However, this simplified example applies to increasingly complex financial services like trading, brokerage, investments, etc. Thus, DeFi solutions are completely peer-to-peer, letting customers transact without needless interruptions or monitoring.

Decentralised Finance vs. Centralised Finance

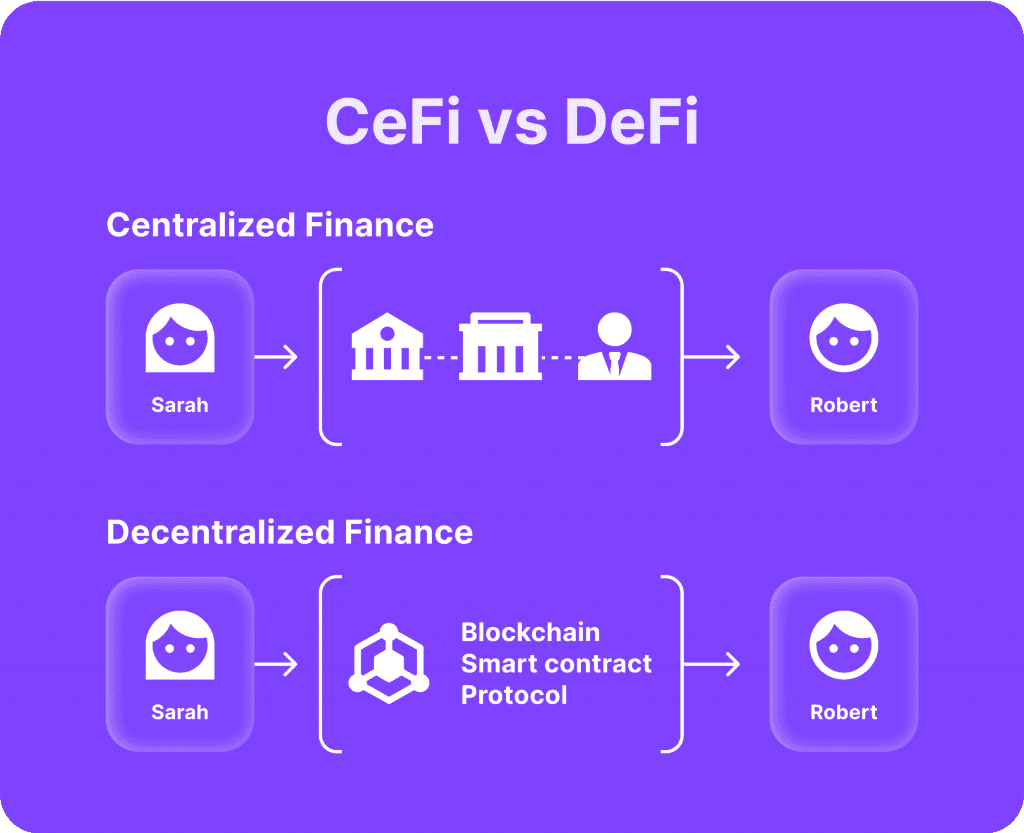

From its humble beginnings, the traditional financial system has reached unprecedented heights in the 21st century. Now, the financial sector encompasses the entire globe, with numerous international organisations servicing cross-border customers and businesses. However, due to its centralised nature, traditional finance has become overly complicated, cost-intensive and prone to unreasonable delays.

While unfortunate, this status quo was an inevitable outcome of globalised traditional finance. The reason for this is that fiat currency institutions employ a system that requires numerous checks, verifications, and approvals to complete a single cross-border transaction.

The Issues with Centralised Finance: Practical Example

Imagine an individual X who wishes to transfer funds from the USA to France as a demonstration. While individual X has the same account and simply wants to relocate their finances, this transaction must flow through various international banks acting as intermediaries. In this case, USA-to-France transfers might require the involvement of up to five institutions to distribute the funds.

While this process seems excessive, it is required by law, as different countries have varying rules and protocols pertaining to money transfers. Thus, individual X must wait for several business days or even weeks to complete a trivial transaction. Moreover, individual X would have to pay outsized fees for this transfer since each intermediary requires compensation for their services rendered. Thus, instead of getting billed for a single commission charge, individual X will receive an accumulated amount of five.

While simplified, the example encapsulates most of the underlying issues related to centralised finance. Needless paperwork, redundant procedures, excessive fees and third-party involvement have become inseparable parts of the fiat financial system. Introducing the DeFi ecosystem aimed to alleviate most of these challenges.

Unlike centralised finance, the DeFi ecosystem utilises blockchain capabilities to eliminate or minimise most of the abovementioned issues. For demonstration, let's imagine the same individual X trying to transfer their money from the USA to France using the DeFi transactions. In this case, individual X must specify the recipient address, the transfer currency and the amount.

Since DeFi platforms thoroughly operate on blockchain technology, they are not subject to third-party involvement. Therefore, individual X's transfer will be processed only on the blockchain network, without several financial institutions needing to check and verify the transaction. This, in turn, means that individual X will not receive excessive commission fees, as there is only a single fee for the DeFi platform.

Finally, the absence of third-party verification means that transactions will not be processed for several days or weeks. As a result, individual X will receive his money in hours without bloated fees and needless third-party interventions.

Pros And Cons of Adopting a DeFi Ecosystem

As discussed above, DeFi technology is a significant milestone in global finance. The DeFi approach opens the door to numerous advantages that can simplify conducting financial operations and minimise related costs. However, DeFi does have its share of shortcomings, which prevent it from becoming a Pareto improvement over centralised finance. Let's take a deeper look at some of the most prominent pros and cons of the DeFi ecosystem.

Decentralisation and Absence of Third Parties

It is difficult to overstate the value of decentralisation in the financial systems. While centralised finance has been a dominant option on the market for centuries, it has produced numerous limitations and security risks. Aside from the above-analysed issues with delayed, overly-monitored and expensive transactions, centralised finance is also susceptible to pressing security threats.

As the name implies, centralised financial systems are operated with a single digital ecosystem. This means that if a centralised system experiences malicious attacks, data disasters or other cyber breaches, the system is vulnerable to a complete breakdown. Due to their technical structure, centralised systems will not be able to localise these breaches, jeopardising the entire network of users with potential data and asset losses.

Moreover, third-party intervention is another pressing matter for the centralised finance model, as each transaction must be approved and verified by one or several authorities. Aside from obvious logistical issues with this approach, it is also constraining in terms of freedom.

With the centralised system, users can conduct financial operations that are entirely satisfactory for several jurisdictions, regulations, and authorities. While some of these regulations are for security reasons, numerous others limit users' financial freedom without proper cause.

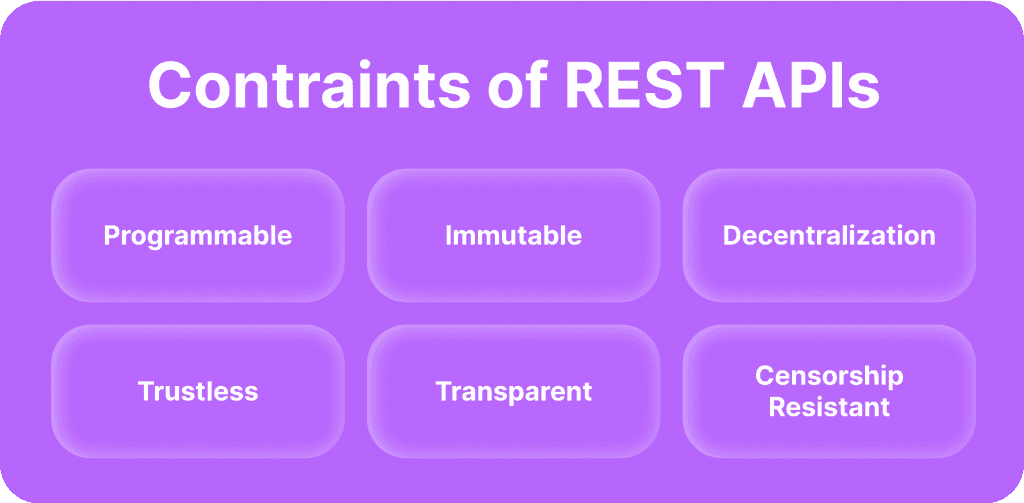

Conversely, the DeFi systems are not limited by numerous regulations of central authorities, as they rely on the immutable and predetermined logic of smart contracts. With proper programming and input of appropriate triggers, SCs can effortlessly process and execute transactions. As a result, DeFi systems can achieve an unrivalled level of efficiency, speed, and freedom of options.

Anonymity and Asset Ownership

Unlike traditional finance, DeFi systems allow individuals to conduct financial business without exposing their identity, personal information and other sensitive data. This level of anonymity enables DeFi users to do business on their own terms and have unprecedented freedom of choice regarding financial transactions.

In centralised systems, customers and businesses must provide sensitive information to utilise financial services. Naturally, many users would prefer to keep their personal and sensitive data private, which is why many individuals and businesses have converted to DeFi systems.

With DeFi, users also have complete ownership over their digital assets. While it might seem intuitive to possess one’s rightful assets completely, it is not precisely the case with centralised systems. In traditional finance, customers do technically own their assets, but in certain situations, the central authority could easily take away their possessions. This could happen for several reasons, varying from system breakdowns to market recessions.

On the other hand, DeFi systems fully delegate asset ownership to their users, which entails that, barring the complete blockchain shutdown, the users will never be parted from their owned assets. Thus, DeFi ecosystems will never take over the assets of individual users, as blockchain technology is built around the principle of complete ownership.

Decentralised Apps Supported by Smart Contracts

As mentioned above, smart contracts are the backbone of the DeFi system, enabling developers to construct applications of any practical kind. Thus, the DeFi ecosystems do not have any technical limitations compared to the centralised finance applications and services. In simple terms, if there is a way to construct sound logic and have appropriate informational inputs in the smart contracts, then any conceivable DeFi application can be developed and launched.

With this level of technical capabilities, DeFi has limitless potential for growth as developers invent new features and functionalities for the audience. As of 2023, the DeFi ecosystems have already innovated beyond the traditional financial tools, and many experts believe that this is the beginning of a promising trend. While centralised finance currently offers similar services to DeFi, it is inherently constrained by several technical and bureaucratic limitations. Therefore, it is highly likely that DeFi ecosystems will swiftly evolve beyond the traditional finance capabilities in the coming years.

Issues with Accessibility

While the DeFi ecosystems have many impressive benefits and improvements over centralised finance, they lack the critical quality of traditional financial services. In most cases, DeFi solutions are overly complex and even convoluted for the majority of users. Since DeFi technology is completely peer-to-peer, users must tend to their own financial needs. This entails that DeFi solutions must be studied and examined thoroughly by potential users, which is not the case with centralised finance.

The same problem persists in terms of service quality. Most DeFi solutions lack the central figure to guide and assist users with emerging issues. As a result, most DeFi solutions have knowledge barriers for the average individuals and businesses on the market. While specific users are highly proficient in blockchain and DeFi technologies, they represent a small fraction of the audience. The rest of the potential market is filled with customers who do not possess sufficient knowledge to understand DeFi tools. Therefore, as DeFi ecosystems will most likely become simplified soon, the complexity of decentralised finance is among the principal reasons for slow adoption progress.

Volatility and Security

While the centralised nature of traditional finance has many drawbacks for users, it also has several advantages, including general market regulation. Central authorities can moderate the market movements and ensure that there are no significant shifts in the status quo. In the case of DeFi, liquidity providers try to act as market regulators, supplying liquidity pools to alleviate specific price changes. However, these measures are still limited compared to the centralised financial models. While freedom is a welcome change, DeFi systems do not have the mechanism to save the market from worst-case scenarios.

Additionally, security has become a grave concern for the DeFi industry. While blockchain was considered one of the safest environments in the digital landscape, malicious attackers have used numerous tactics to corrupt the DeFi systems. As a result, the DeFi ecosystems are not nearly as sturdy and impenetrable as before, which is an important factor to consider for potential customers.

Final Takeaways

Before the introduction of DeFi, the financial world acknowledged the limitations of centralised finance, but the market had no practical options. With DeFi, the status quo has been changed, and the global financial landscape has received a much-needed upgrade.

However, the complexity and absence of moderation mechanisms in DeFi platforms have yet to be addressed with appropriate solutions. It will be fascinating to see whether DeFi methodologies will overcome their core limitations and earn their reputation as a fully-fledged alternative to centralised financial practices.

Read also